mobile al vehicle sales tax

Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs. Mobile County License Commission.

Additional Tax Breaks Considered For K C Mobile Expansion Lagniappe Mobile

Vehicle Sales Purchases Orange County Tax Collector Free Local Delivery With A Minimum Purchase Of 1 799 Come By Our Daphne And Mobile Showrooms Today Alittleextra.

. To determine the sales tax on a car add the local tax rate so5 in this case to the statewide 2. According to the Alabama Department of Revenue Alabama charges 2 for auto sales tax. Alabama has a 4 statewide sales tax rate but also has 377 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 5079.

The actual sales tax may vary depending on the location as some countiescities charge additional. You can calculate out-of-state sales tax tag title and other fees based on the customer post code. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Mobile AL is 10000. Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by businesses located in Alabama. Address and daytime phone.

800 to 300 Monday Tuesday Thursday and Fridays and. 251 574 - 8551. Visa MasterCard or Discover.

Including city and county vehicle sales taxes the total sales tax due will. Mobile AL 36652-3065 Office. This is the total of state county and city sales tax rates.

Additionally local county taxes can be applied as well up to about 4. Revenue Office Government Plaza 2nd Floor Window Hours. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax.

The December 2020 total local sales tax rate was also 10000. Valid motor vehicle insurance card with NAIC number policy number and VIN to be faxed emailed or mailed. The Alabama state sales tax rate is currently.

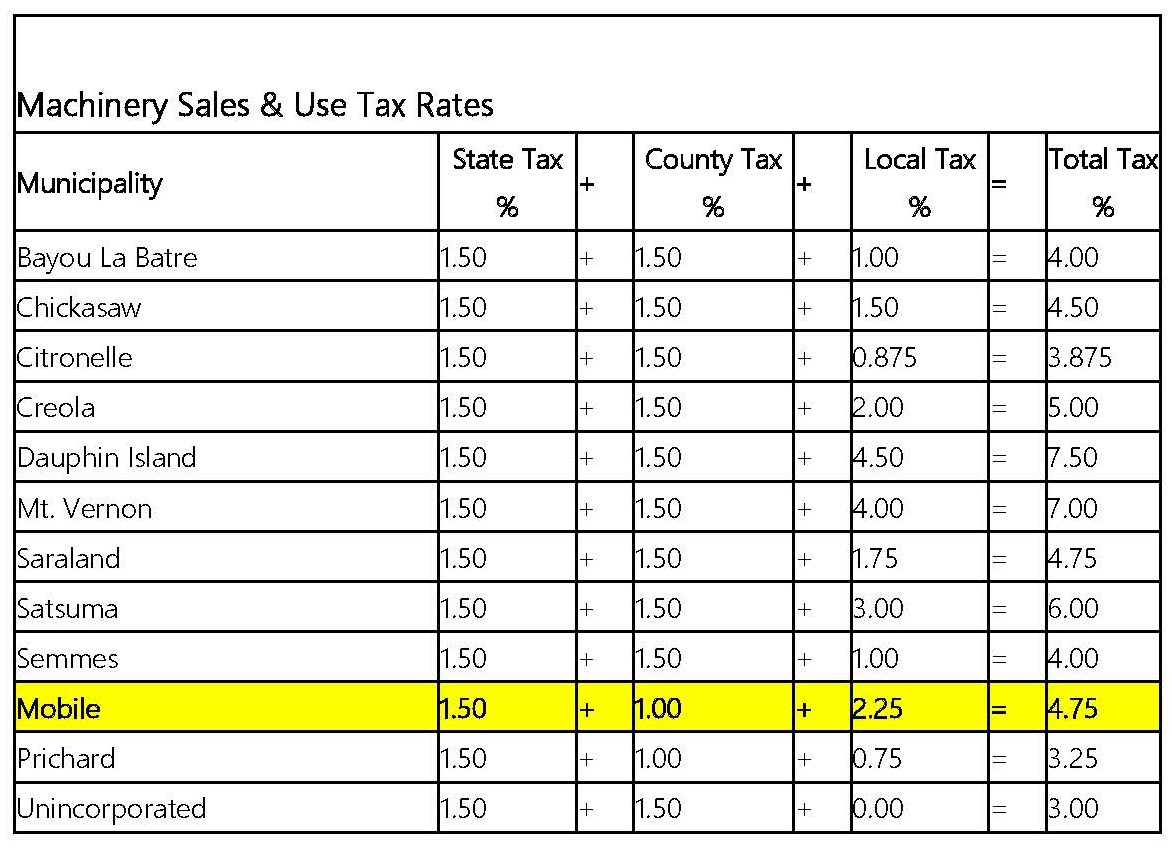

The tax is collected by the seller. 10 rows INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED EDUCATION LODGING. Compared to other states Alabamas state auto sales tax rate is modest at 2 percent of the purchase price.

You can print a 10 sales tax table. The minimum combined 2022 sales tax rate for Mobile Alabama is 10. Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609.

The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500. There is no applicable special tax. Mobile County levies a county wide Sales Use and Lease Tax and also administers a Mobile County School Sales and Use Tax in county areas outside the corporate limits of Prichard and.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Mobile County Alabama is. The Alabama sales tax rate is currently 4.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as. Mobile AL Sales Tax Rate.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Mullinax Ford Of Mobile Al New Ford And Used Car Dealership

Welcome To U J Chevrolet In Mobile Al

Sales Tax Holidays Politically Expedient But Poor Tax Policy

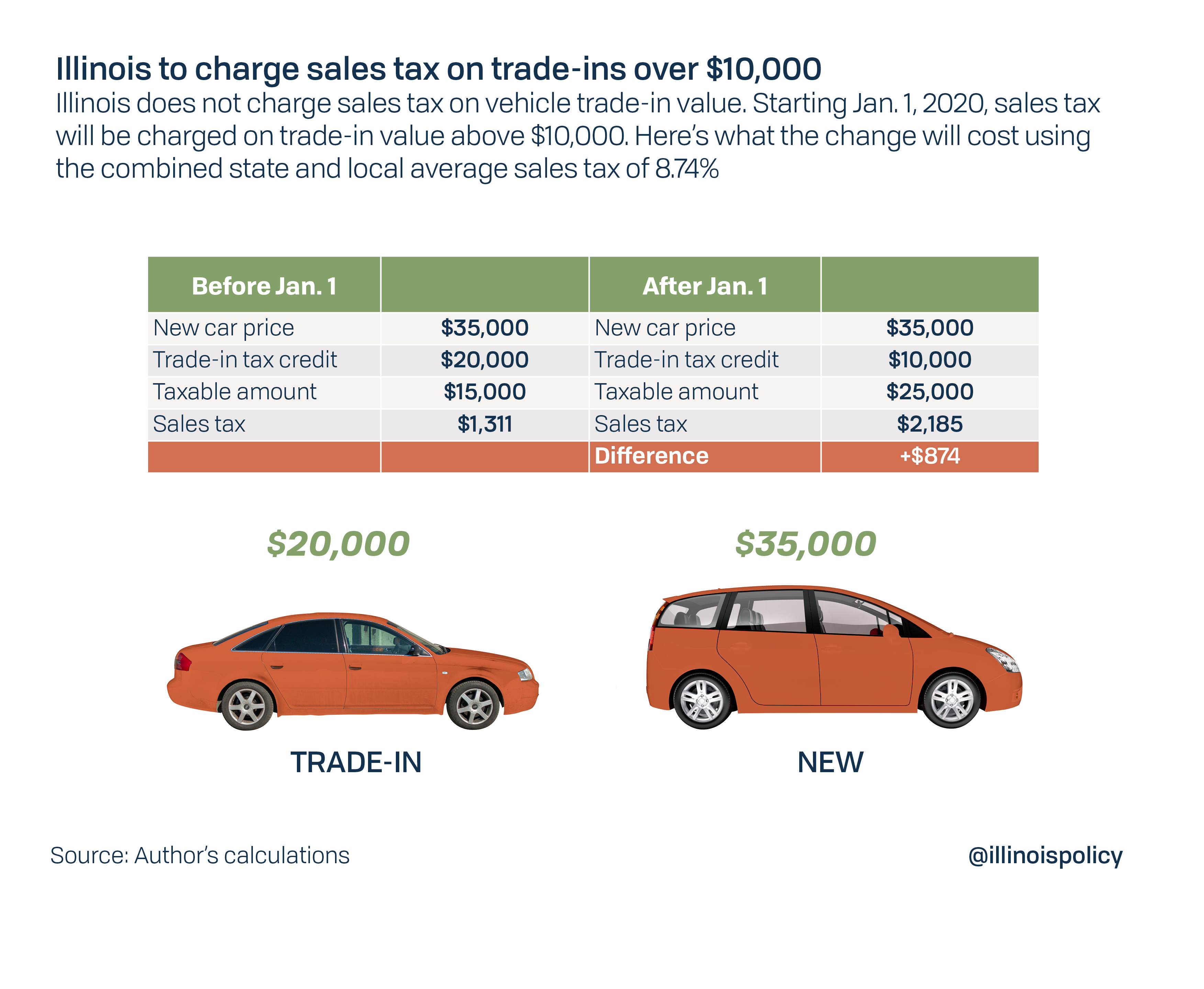

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used 2007 Chevrolet Tahoe Ltz For Sale In Mobile Al Cargurus

Mobile County License Commission Office In Eight Mile Closing For Renovations Al Com

Sales Taxes In The United States Wikiwand

Get Used Auto Parts Used Cars At Mobile S 1 Junkyard

Official Mobile County License Commission Adam Bourne Nick Matranga

Joe Bullard Chevrolet Dealer Mobile New And Used Car Dealership Mobile Al

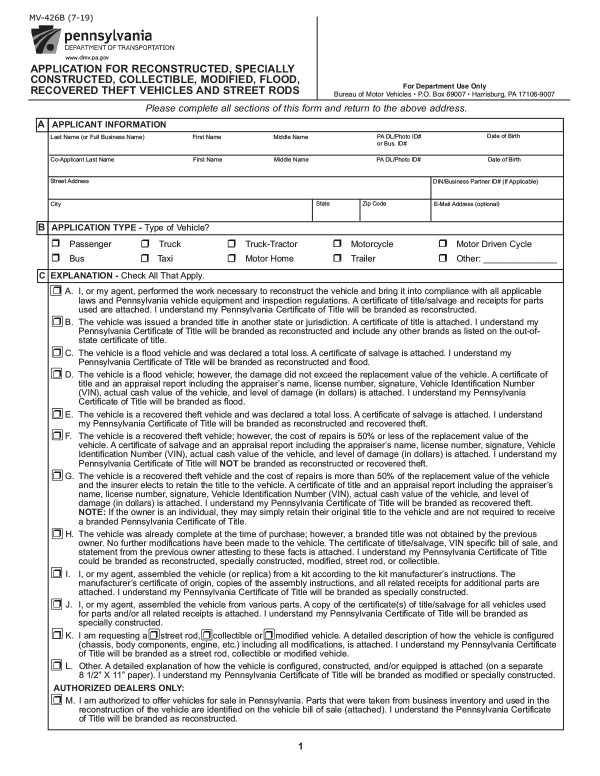

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

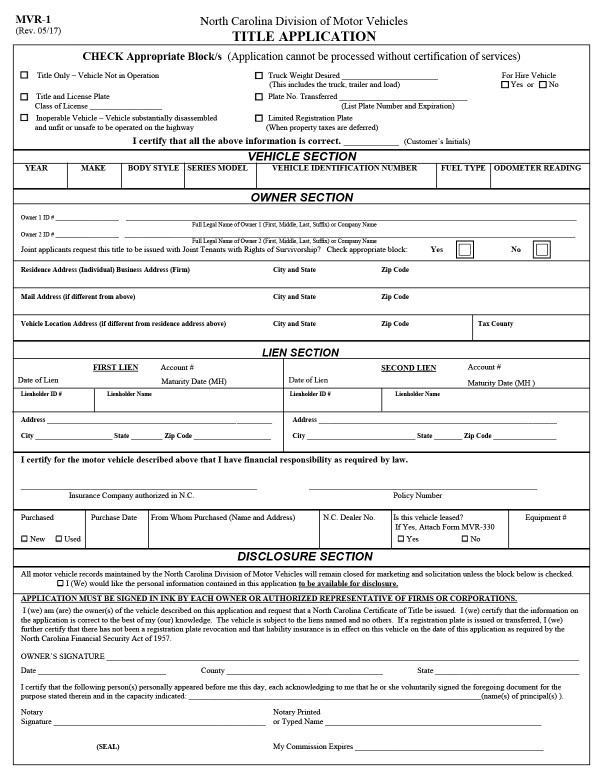

All About Bills Of Sale In North Carolina The Forms Facts You Need